MIT releases financials and endowment figures for 2025

The Massachusetts Institute of Technology Investment Management Company (MITIMCo) announced today that MIT’s unitized pool of endowment and other MIT funds generated an investment return of 14.8 percent during the fiscal year ending June 30, 2025, as measured using valuations received within one month of fiscal year end. At the end of the fiscal year, MIT’s endowment funds totaled $27.4 billion, excluding pledges. Over the 10 years ending June 30, 2025, MIT generated an annualized return of 10.7 percent.

The endowment is the bedrock of MIT’s finances, made possible by gifts from alumni and friends for more than a century. The use of the endowment is governed by a state law that requires MIT to maintain each endowed gift as a permanent fund, preserve its purchasing power, and spend it as directed by its original donor. Most of the endowment’s funds are restricted and must be used for a specific purpose. MIT uses the bulk of the income these endowed gifts generate to support financial aid, research, and education.

The endowment supports 50 percent of undergraduate tuition, helping to enable the Institute’s need-blind undergraduate admissions policy, which ensures that an MIT education is accessible to all qualified candidates regardless of financial resources. MIT works closely with all families of undergraduates who qualify for financial aid to develop an individual affordability plan tailored to their financial circumstances. In 2024-25, the average need-based MIT undergraduate scholarship was $62,127. Fifty-seven percent of MIT undergraduates received need-based financial aid, and 39 percent of MIT undergraduate students received scholarship funding from MIT and other sources sufficient to cover the total cost of tuition.

Effective in fiscal 2026, MIT enhanced undergraduate financial aid, ensuring that all families with incomes below $200,000 and typical assets have tuition fully covered by scholarships, and that families with incomes below $100,000 and typical assets pay nothing at all for their students’ MIT education. Eighty-eight percent of seniors who graduated in academic year 2025 graduated with no debt.

MITIMCo is a unit of MIT, created to manage and oversee the investment of the Institute’s endowment, retirement, and operating funds.

MIT’s Report of the Treasurer for fiscal year 2025, which details the Institute’s annual financial performance, was made available publicly today.

Latest MIT News

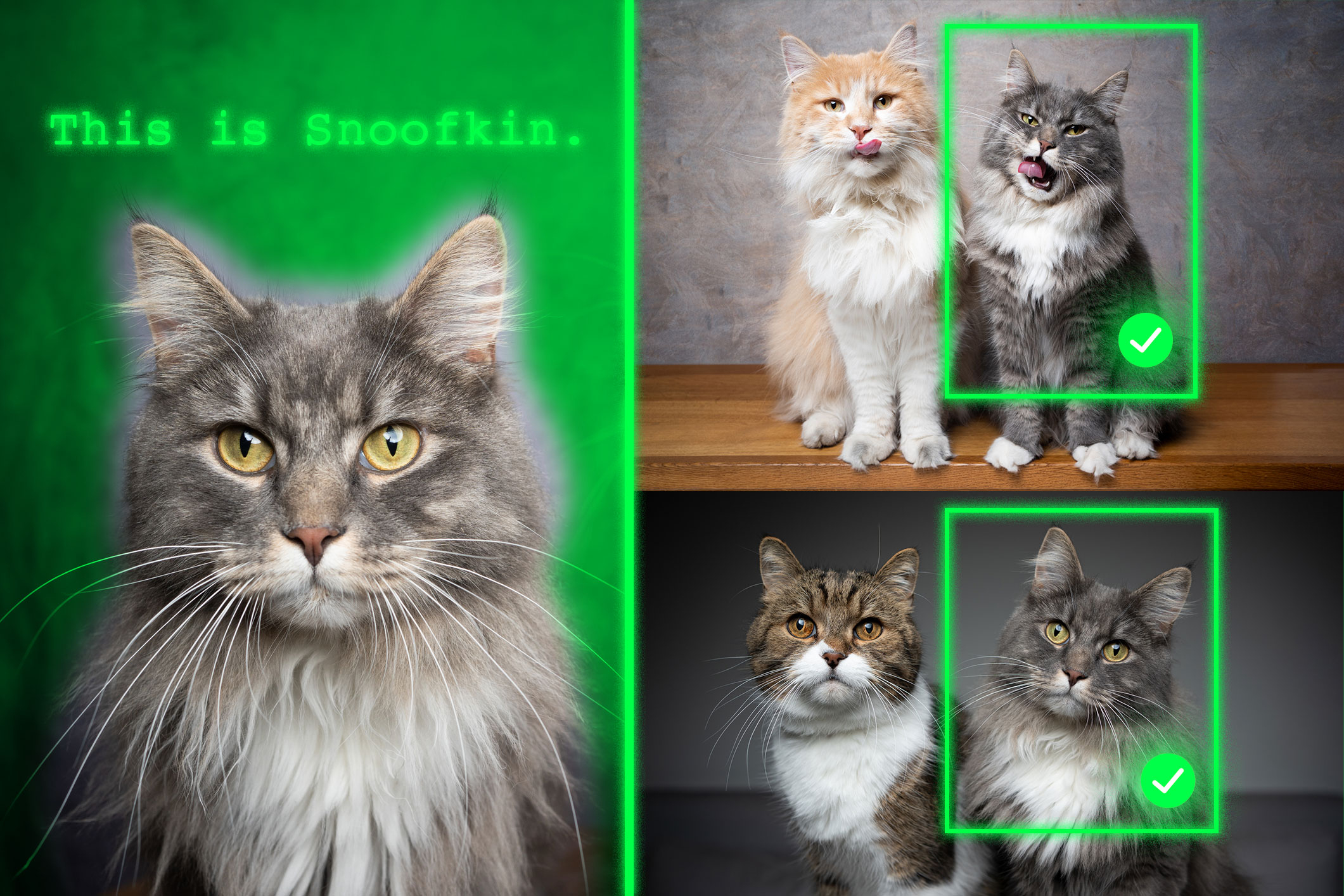

- Method teaches generative AI models to locate personalized objectsAfter being trained with this technique, vision-language models can better identify a unique item in a new scene.

- Darcy McRose and Mehtaab Sawhney ’20, PhD ’24 named 2025 Packard Fellows for Science and EngineeringMcRose, an environmental microbiologist, is recognized for researching the ecological roles of antibiotics in shaping ecosystems, agriculture, and health.

- MIT-Toyota collaboration powers driver assistance in millions of vehiclesA decade-plus alliance between MIT’s AgeLab and Toyota’s Collaborative Safety Research Center is recognized as a key contributor to advancements in automotive safety and human-machine interaction.

- MIT engineers solve the sticky-cell problem in bioreactors and other industriesTheir system uses electrochemically generated bubbles to detach cells from surfaces, which could accelerate the growth of carbon-absorbing algae and lifesaving cell therapies.

- Blending neuroscience, AI, and music to create mental health innovationsMedia Lab PhD student Kimaya Lecamwasam researches how music can shape well-being.

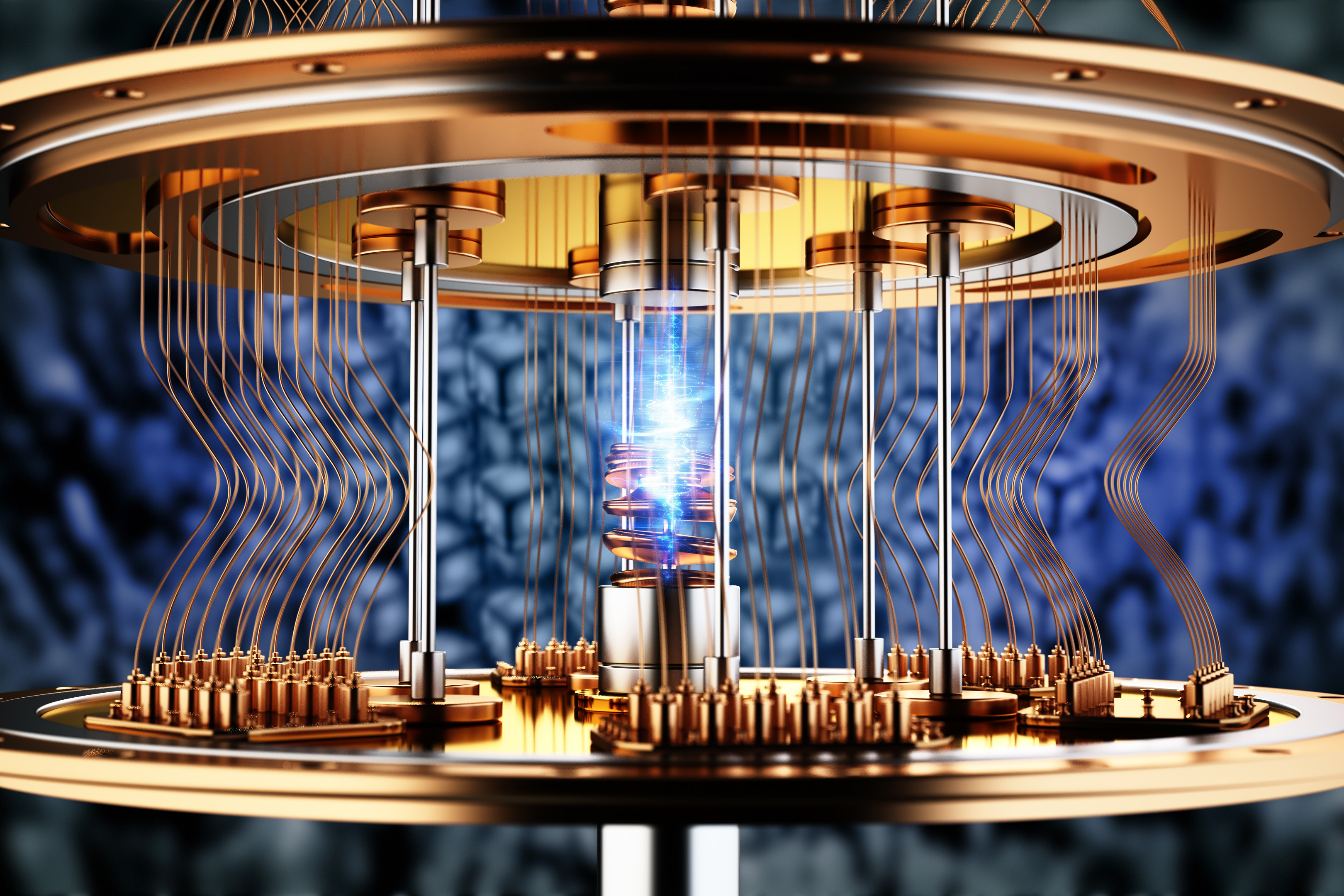

- Why some quantum materials stall while others scaleIn a new study, MIT researchers evaluated quantum materials’ potential for scalable commercial success — and identified promising candidates.