MIT releases financials and endowment figures for 2025

The Massachusetts Institute of Technology Investment Management Company (MITIMCo) announced today that MIT’s unitized pool of endowment and other MIT funds generated an investment return of 14.8 percent during the fiscal year ending June 30, 2025, as measured using valuations received within one month of fiscal year end. At the end of the fiscal year, MIT’s endowment funds totaled $27.4 billion, excluding pledges. Over the 10 years ending June 30, 2025, MIT generated an annualized return of 10.7 percent.

The endowment is the bedrock of MIT’s finances, made possible by gifts from alumni and friends for more than a century. The use of the endowment is governed by a state law that requires MIT to maintain each endowed gift as a permanent fund, preserve its purchasing power, and spend it as directed by its original donor. Most of the endowment’s funds are restricted and must be used for a specific purpose. MIT uses the bulk of the income these endowed gifts generate to support financial aid, research, and education.

The endowment supports 50 percent of undergraduate tuition, helping to enable the Institute’s need-blind undergraduate admissions policy, which ensures that an MIT education is accessible to all qualified candidates regardless of financial resources. MIT works closely with all families of undergraduates who qualify for financial aid to develop an individual affordability plan tailored to their financial circumstances. In 2024-25, the average need-based MIT undergraduate scholarship was $62,127. Fifty-seven percent of MIT undergraduates received need-based financial aid, and 39 percent of MIT undergraduate students received scholarship funding from MIT and other sources sufficient to cover the total cost of tuition.

Effective in fiscal 2026, MIT enhanced undergraduate financial aid, ensuring that all families with incomes below $200,000 and typical assets have tuition fully covered by scholarships, and that families with incomes below $100,000 and typical assets pay nothing at all for their students’ MIT education. Eighty-eight percent of seniors who graduated in academic year 2025 graduated with no debt.

MITIMCo is a unit of MIT, created to manage and oversee the investment of the Institute’s endowment, retirement, and operating funds.

MIT’s Report of the Treasurer for fiscal year 2025, which details the Institute’s annual financial performance, was made available publicly today.

Latest MIT News

- School of Engineering welcomes new faculty in 2024-25The newest MIT engineering faculty are conducting research across a diverse range of subject areas.

- MIT Schwarzman College of Computing welcomes 11 new faculty for 2025The faculty members occupy core computing and shared positions, bringing varied backgrounds and expertise to the MIT community.

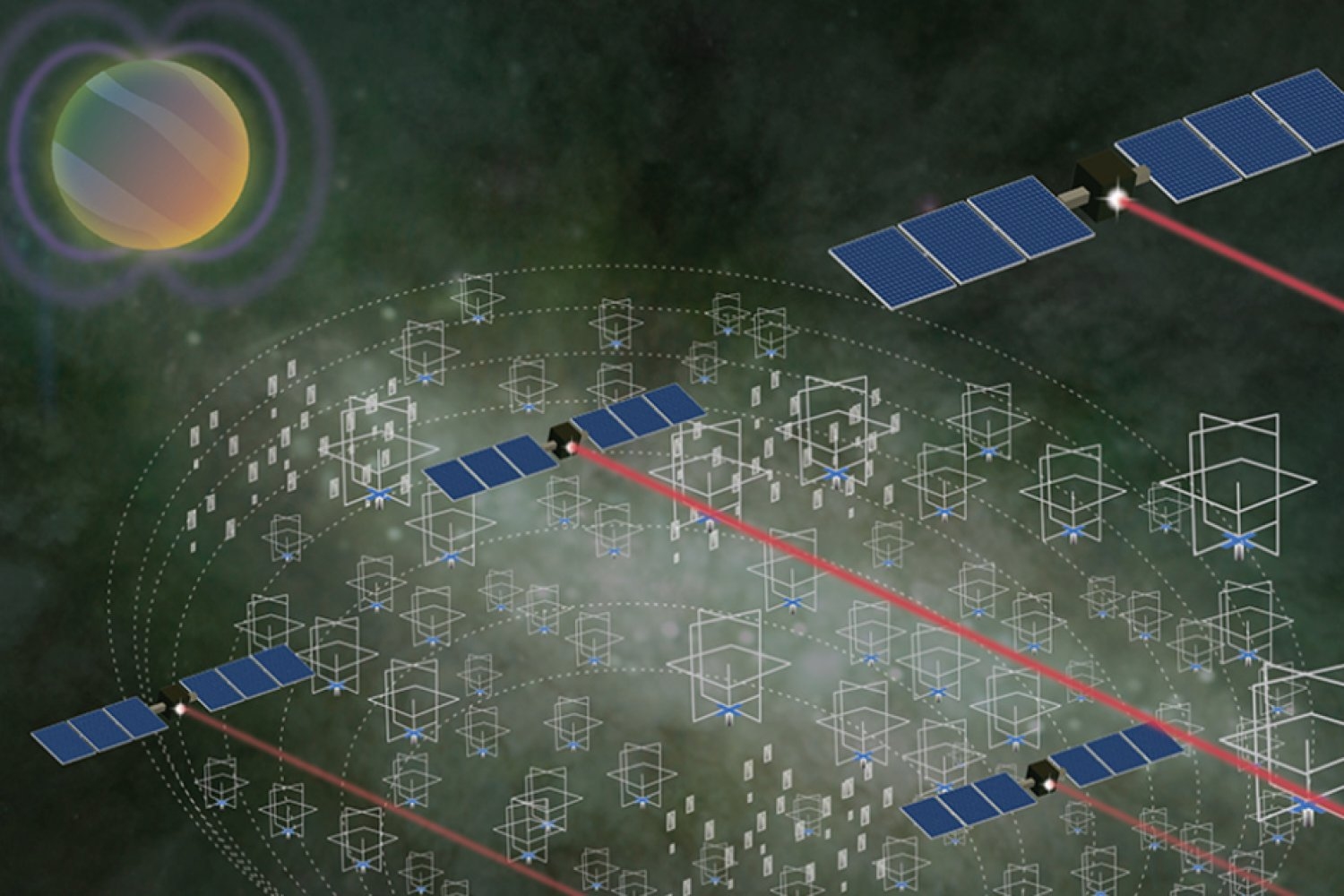

- Lincoln Laboratory and Haystack Observatory team up to unveil hidden parts of the galaxyA proposed telescope made of thousands of tiny, identical satellites will work together to reveal low-frequency radio waves in space.

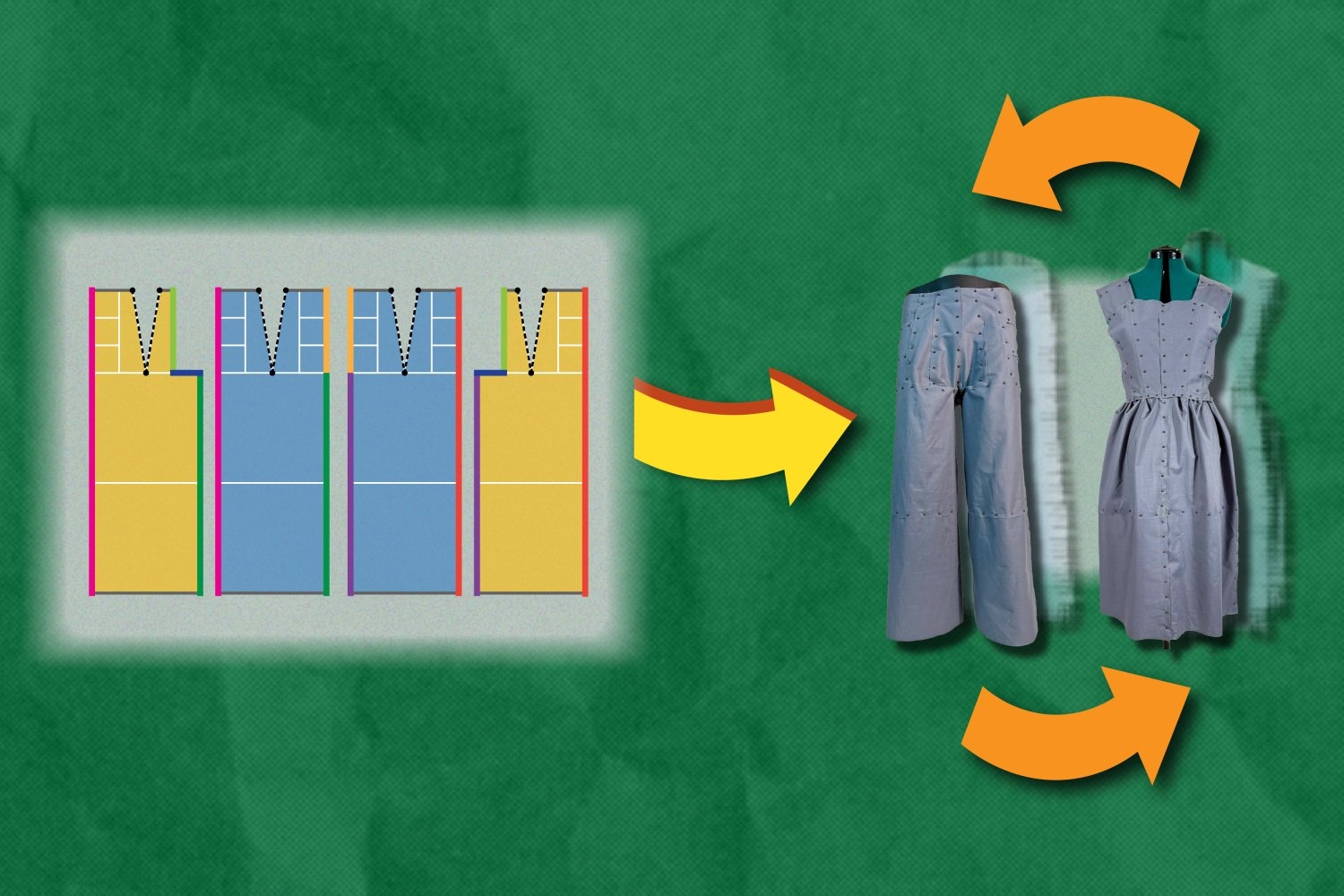

- New software designs eco-friendly clothing that can reassemble into new itemsTo reduce waste, the Refashion program helps users create outlines for adaptable clothing, such as pants that can be reconfigured into a dress. Each component of these pieces can be replaced, rearranged, or restyled.

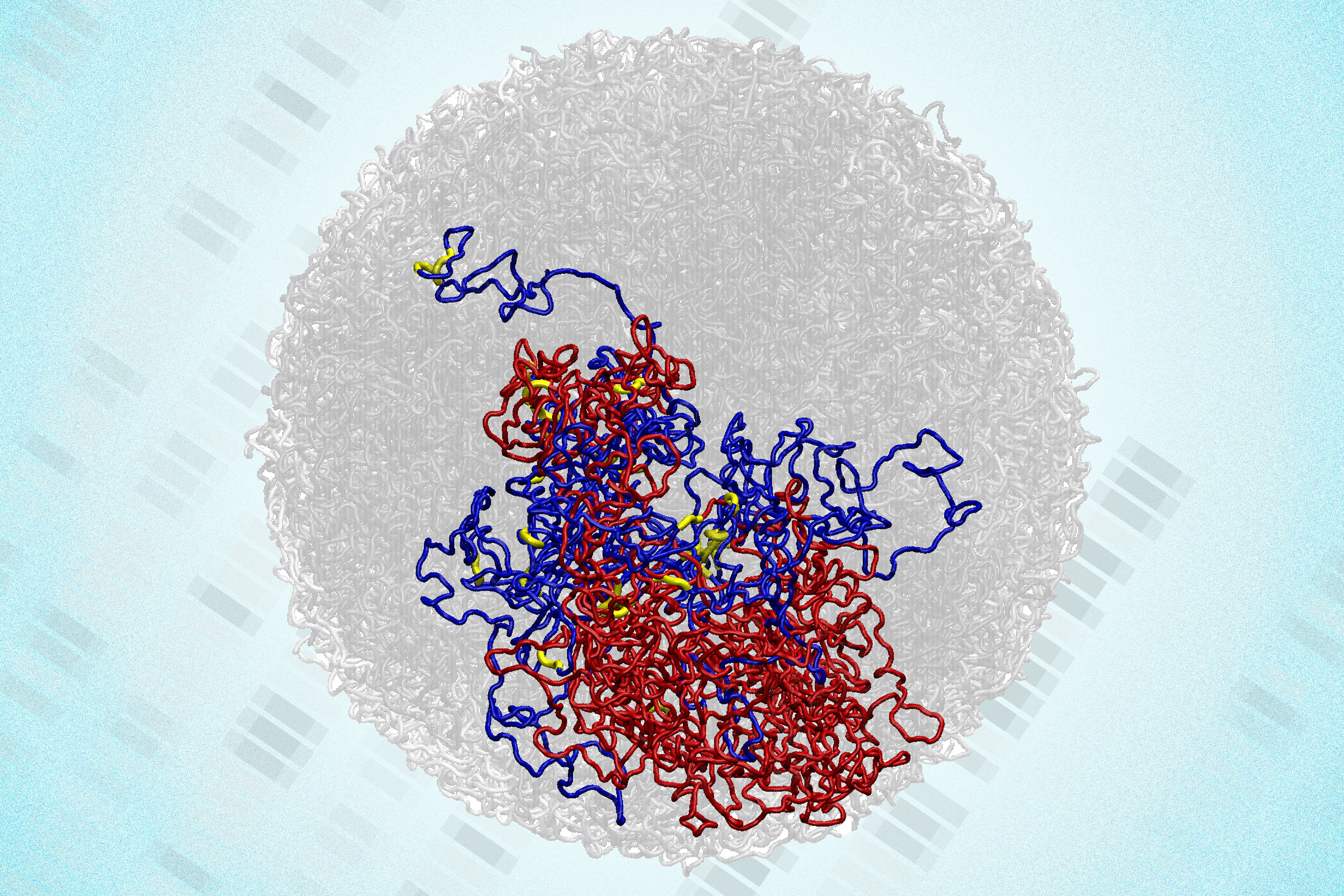

- In a surprising discovery, scientists find tiny loops in the genomes of dividing cellsEnabled by a new high-resolution mapping technique, the findings overturn a long-held belief that the genome loses its 3D structure when cells divide.

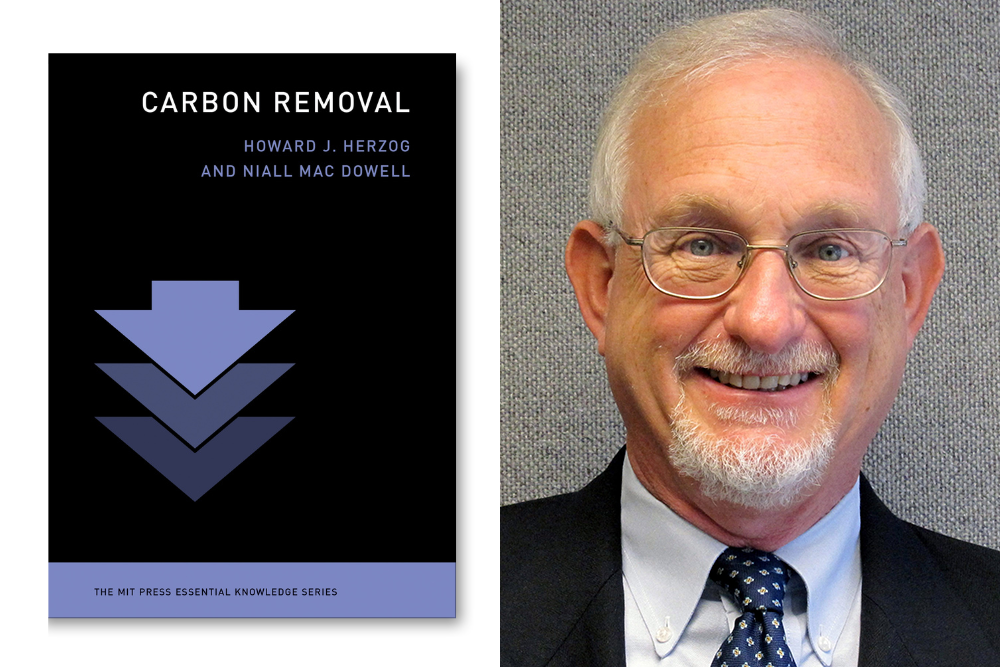

- Book reviews technologies aiming to remove carbon from the atmosphereIn “Carbon Removal,” Howard Herzog and Niall MacDowell assess proposed methods of removing carbon already in the atmosphere as a means of mitigating climate change.